2022 rmd calculator

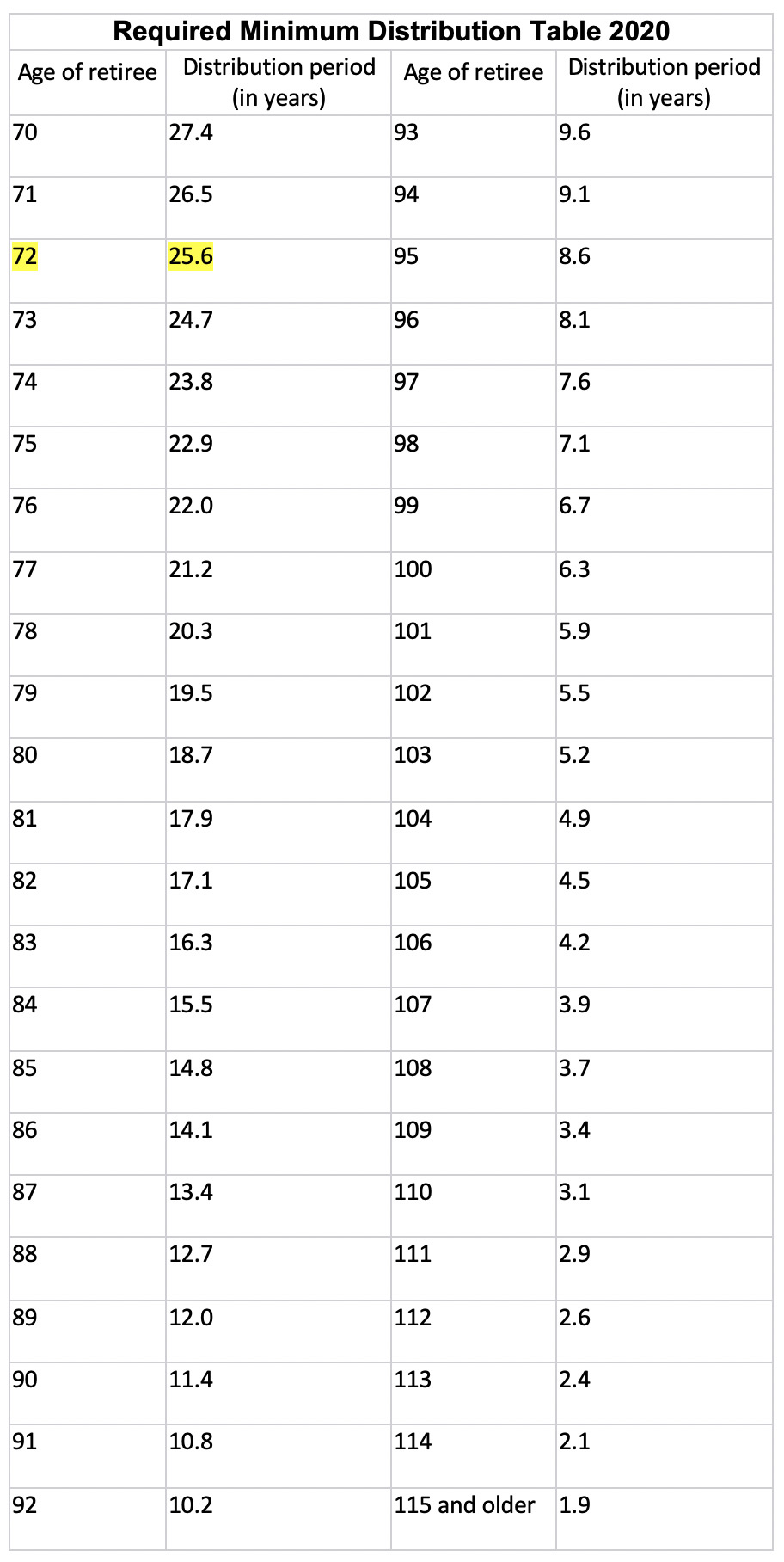

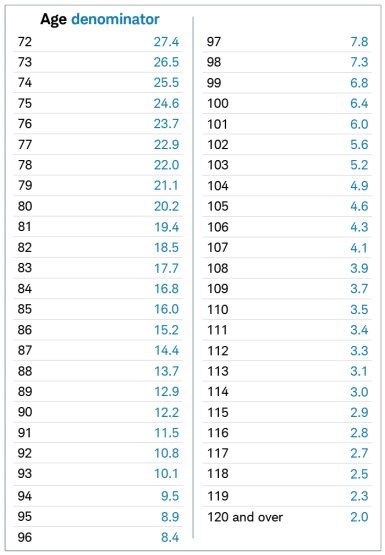

The IRS has published new Life Expectancy figures effective 112022. Divide that factor into the account balance on December 31 2021 to arrive at your RMD for 2022.

If You Reached Age 72 In 2021 You Might Or Might Not Have Until April 1 2022 To Take Your 2021 Rmd

Thats because the IRS released new life expectancy tables for 2022 which impacted your RMD calculation.

. The new rules and life expectancy tables are in free IRS Publication 590-b available on the IRS. If you do this youll need to take two distributions in the same tax year. Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match.

The new tables are not effective until 2022. Call us at 866-855-5636. The table is very lengthy as it has every combination of ages for 10 spouses 10-years apart in age.

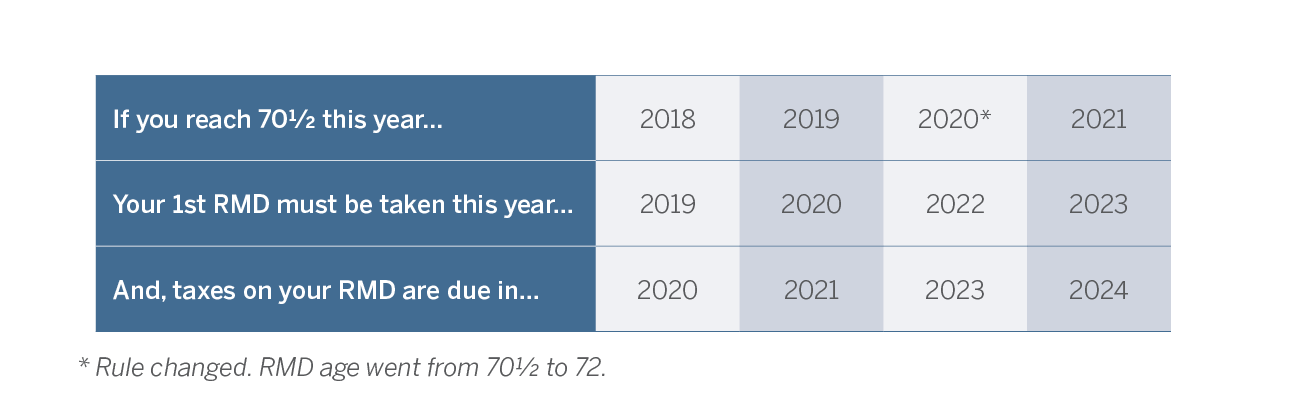

RMDs are waived for 2020 and. This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules. If you have multiple IRAs you must calculate each account individually but you can take your total RMD amount from one IRA or a combination of IRAs.

I deferred taking an RMD in 2020 and I took an RMD in 2021 using 295 as the life expectancy divisor. Or you can use a calculator like this one from T. If your spouse is more than ten years younger than you please review IRS Publication 590-B to calculate your required minimum distribution.

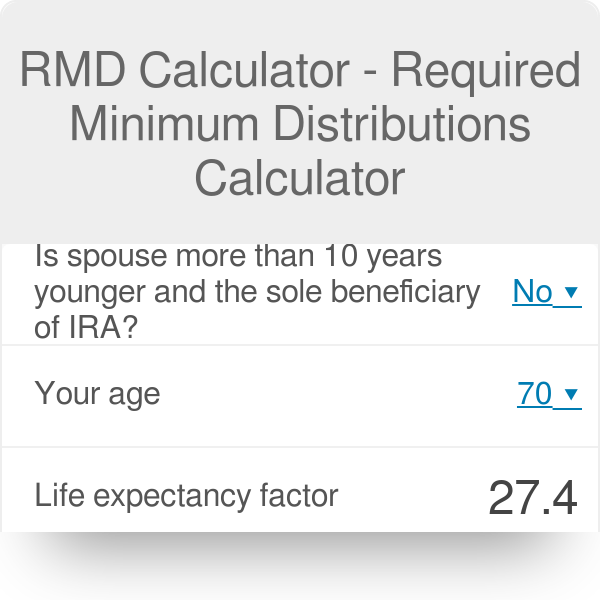

RMD in order to avoid a penalty. Required Minimum Distribution RMD Calculator. Complete your first RMD by April 1.

By Christy Bieber Updated Jul 8 2022 at 519PM 401k accounts are workplace retirement savings plans that employees can contribute to with. This calculator has been updated to reflect the new figures. Complete your second RMD by December 31.

590-B called Distributions from Individual Retirement Arrangements. The life expectancy of the oldest beneficiary will be used to calculate the RMD. Since Paul had not reached age 70½ before 2020 his first RMD is due for 2021 the year he turns 72.

To calculate your RMD start by visiting the IRS website and. To make paperwork easier you can also have the taxes withheld from your distribution 10 will automatically be held for federal taxes if you choose this option but you can elect to have. If you were born on or after 711949 your first RMD will be for the year you turn 72.

Here are the 401k RMD rules for 2021 and 2022. Please speak with your plan administrator for details. Use this calculator to determine your Required Minimum Distributions RMD as a beneficiary of a.

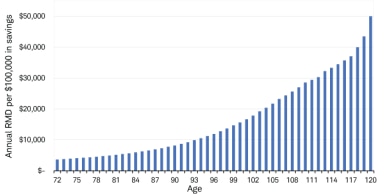

You can look forward to somewhat smaller required minimum distributions RMDs from your IRA and company retirement savings plan beginning in 2022. Official RMD Tables for 2022 RMDs. Get a quick estimate of how much you could have to spend every month and explore ways to impact your cash flow in retirement.

The IRS has published new Life Expectancy figures effective 112022. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401k account this year. If youve turned 72 this year you have the option to complete your first RMD by April 1 of next year.

Thats because on November 6 the IRS released new life expectancy tables that are used to calculate RMDs. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from some types of retirement accounts annually. If you fail to take an RMD the IRS will impose an additional 50 penalty on your RMD amount.

31 2022 and by Dec. A Primer on RMDs. The Calculator does not consider the effect of taxes on the RMD withdrawn and the amount owed in taxes on the withdrawal is not.

Most non-spouse beneficiaries will be required to withdraw the entirety of an. Rowe Price to estimate your distribution you must take a minimum amount but you can always take out more. Retirement Strategies Tax Estimator.

The custodian of my account is telling. The SECURE Act of 2019 changed the age that RMDs must begin. If you defer your first RMD 2022 RMD until April 1 2023 please note you will also need to take your 2023 RMD before December 31 2023.

Use this calculator to determine your required minimum distributions RMD from a traditional IRA. This could have tax implications. The SECURE Act of 2019 raised the age for taking RMDs from 70 ½ to 72 for those born after July.

Paul must receive his 2022 required minimum distribution by December 31 2022 based on his 2021 year-end balance. For more information consult with our tax advisor. There is another table for IRA account holders with spouses 10 or more years younger where the spouse is name as the sole beneficiary.

RMDs are withdrawals you have to make from most retirement plans excluding Roth IRAs when you reach the age of 72 or 705 if you were born before July 1 1949The amount you must withdraw depends on the balance in your account and your life expectancy as defined by the IRS. For 2022 I was expecting to use 285 as the divisor. If you inherit an IRA RMD rules apply.

The 2021 deferral limit for 401k plans was 19500 the 2022 limit is 20500. Generally your RMDs are taxed as regular income within the year they are taken but RMDs can also be subject to state and local taxes. Pauls first RMD is due by April 1 2022 based on his 2020 year-end balance.

Use our RMD Calculator to find the amount of your RMD based on your age account balance beneficiaries and other factors. This table provides more favorable ie. If you were born.

The SECURE Act changes the distribution rules for beneficiaries of account owners who pass away in 2020 and beyond. The IRA RMD calculator is based on Table II Joint Life and Last Survivor Expectancy and Table III Uniform Lifetime Table from IRS Publication 590-B 2021 opens new window. The official place to look for the tables that apply for 2022 RMDs is the 2021 IRS Pub.

If your spouse is the sole beneficiary and is more than ten years younger than you you will use Table II. Determine your required retirement account withdrawals after age 72 Retirement Income Calculator. Use this calculator to determine your Required Minimum Distribution RMD.

A lower RMD means you may have a larger account balance for future years and your 2022 taxable income will most likely be reduced. Youll have to take another RMD by Dec. Our RMD calculator.

31 each year after that. For example if your RMD was 5000 and you missed the deadline to take it the IRS would issue a penalty of 2500. Non-IRA retirement plans such as 401k or 403b plans may have different deadlines.

This calculator has been updated to reflect the new figures. RMD is calculated based on life expectancy and the account balance at.

Mail Addressed To You Return Address Irs Article By Pearson Co

How The Secure Act Favors Retirement Savers Born In The First Half Of The Year

How To Calculate Rmd In Year Of Death

How The Irs S New Rmd Tables For 2022 Affect Your Retirement

Required Minimum Distribution Rules Sensible Money

Iras Calculating Your Rmds Youtube

Understanding Rmds And What You Need To Know For 2022 Agemy Financial Strategies

What You Need To Know About Rmds In 2022 Required Min Distributions Retirement Watch

Rmd Strategies To Help Ease Your Tax Burden Retirement Plan Services

If You Reached Age 72 In 2021 You Might Or Might Not Have Until April 1 2022 To Take Your 2021 Rmd

Ira Withdrawal Calculator Shop 50 Off Www Groupgolden Com

Understanding Required Minimum Distributions Advanced Tax Strategies For Rmd S Greenbush Financial Group

Rmd Strategies To Help Ease Your Tax Burden Retirement Plan Services

What Is A Required Minimum Distribution Or Rmd Victory Capital

What Is Changing With Rmds In 2022

Rmd Calculator Required Minimum Distributions Calculator

If You Reached Age 72 In 2021 You Might Or Might Not Have Until April 1 2022 To Take Your 2021 Rmd